s corp late filing letter

If the business owner andor accountant did not receive the letter or do. After this is completed the IRS sends a CP261 Notice to businesses to confirm acceptance of the S Corporation election.

Sample Tax Notice Response Valid Prettier Models Irs Response Throughout Irs Response Letter Template Letter Templates Lettering Coloring Pages Inspirational

Send the letter charge your client and move forward.

. Or e an IRS letter stating the election has been. Your tax pro may be able to help you with S corporation and. 23 August 2011.

Here are a few examples of the abatement letters for late S-Corps. On the site with all the document click on Begin immediately along with complete for the editor. It has been caused by indifference or neglect on the part of the taxpayers.

Use your indications to submit established. Generally an S corporation must file Form 1120-S by the 15th day of the 3rd month after the end of its tax year. Income Tax Return for an S Corporation PDF reporting incomeloss for the S corporation including Schedules K-1 1120-S Shareholders Share of Income.

2 months and 15 days. If the entity qualifies and files timely in accordance with Rev. To be a S-Corp beginning with its first tax year it must file Form 2553 during the period that begins January 7th 2019 and ends March 21st 2019 ie.

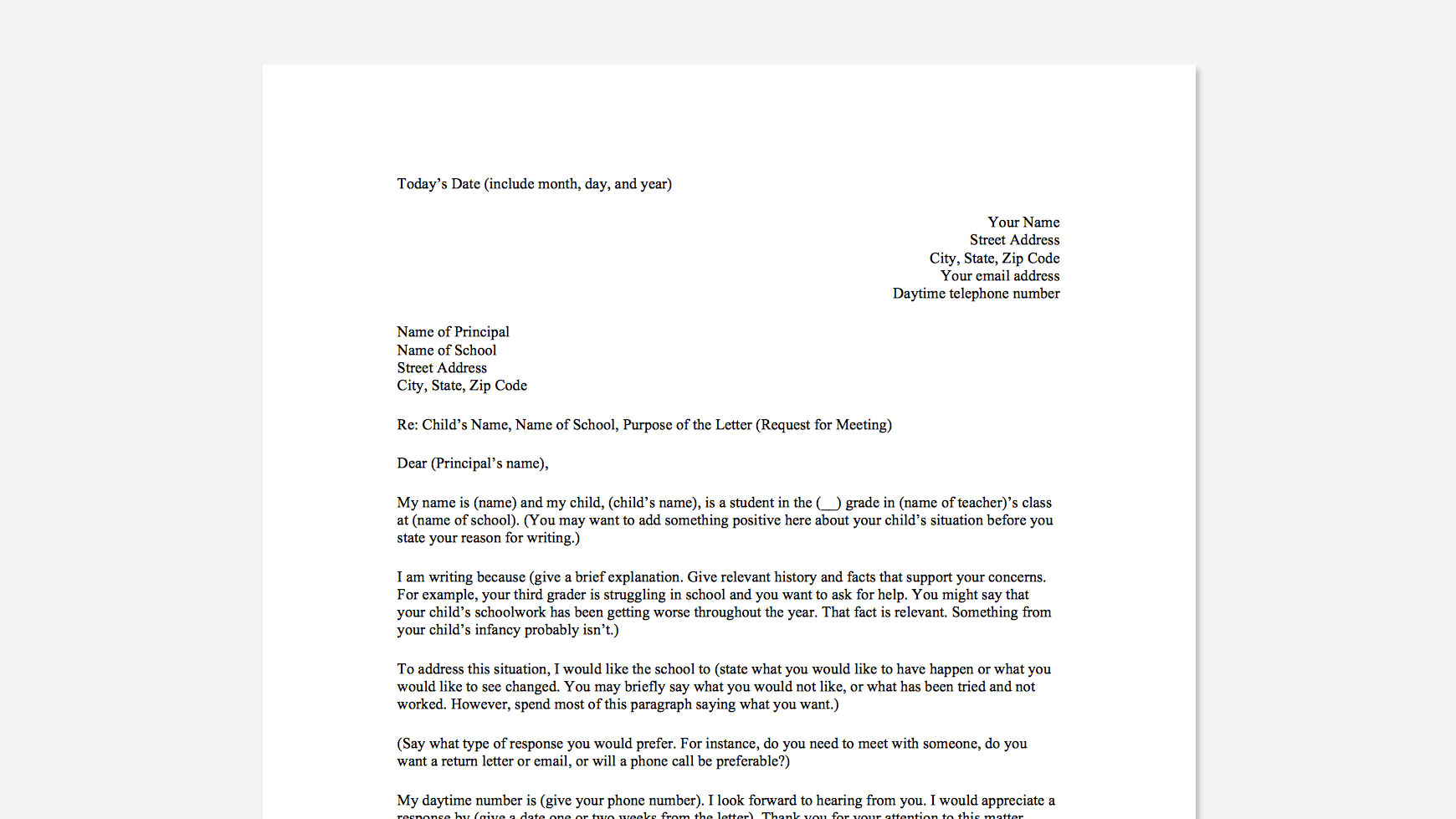

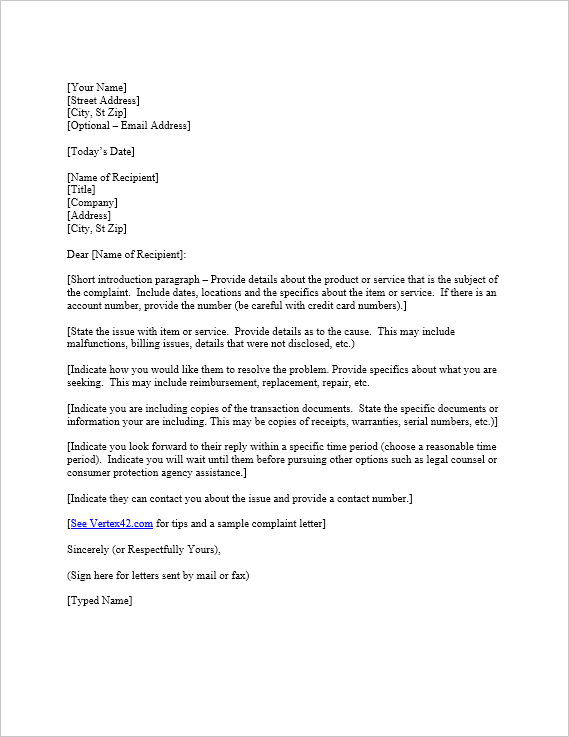

If we correctly charged the partnership or S corporation a penalty for filing late but you believe it had reasonable cause for doing so you can mail a written explanation requesting. If you filed a S corporation or partnership return late in the past few years you have likely seen a penalty notice for late filing. What Is the S Corp Late Filing Penalty Abatement.

If the entity does not qualify under the provisions of the. 2013-30 the Campus can grant late election relief. C Form 2553 with stamped IRS received date.

Of filing are a certified or registered mail receipt. IRS Internal Revenue Code IRC Section IRC Sec. Timely file Form 1120-S US.

A late election to be an S corporation and a late entity classification election for the same entity may be available if the entity can show that the failure to file Form 2553 on. The S Corp Late Filing Penalty Abatement is a waiver that a company can apply for to ask the IRS to reduce or eliminate. How much is the late filing penalty for.

If the return is late penalties accrue from the first day at 5 percent of the unpaid tax for every month or portion of a month late. According to IRM 201136 the IRSs Reasonable Cause Assistant provides an option for penalty relief for failure-to-file failure-to-pay and failure-to-deposit penalties if the taxpayer meets. Create Your Legal Contracts Today.

You did not delay 2 years. This one was for a newly formed S-Corp client. Within a few months the IRS should send you a determination letter stating the effective date of your S.

6699 filing an S-Corporation return late results in a per month tax penalty of 195 multiplied by the number of shareholders. The maximum penalty is 25 percent of the. If you cannot meet the filing deadline an LLC partnership or S corporation can be granted a 6-month extension of time by filing Form 7004 Application for Automatic Extension.

The S Corp Late Filing Penalty Abatement is a waiver that a company can apply for to ask the IRS to reduce or eliminate assessed penalties. I received the attached notice of penalty. Ad Trusted by Millions of Americans Like You.

After you file your late S corporation election all you can do is wait. B Form 2553 with an accepted stamp. How to complete any 2021 IRS 1065 online.

Dont let them draw. Professional Legal Solutions for All of Your Personal and Business Needs. For calendar year corporations the due date is March 15 2022.

Download Sample Letters For Dispute Resolution Understood For Learning And Thinking Differences

Sample Cease And Desist Letter To Former Employee Beautiful 10 Cease And Desist Letter Template Letter Templates Collection Letter Letter Sample

Get Our Sample Of Charge Off Dispute Letter Template For Free Collection Letter Letter Templates Letter Templates Free

Free Complaint Letter Template Sample Letter Of Complaint

Pin On Templates

Apology Letters Print Paper Templates Printable Paper Templates Sampleresume Apologylettersam Business Letter Format Lettering Business Letter Format Example

Apology Letter For Being Late In Submission Sample Letter

Apology Letter For Being Late In Submission Sample Letter

37 Editable Grievance Letters Tips Free Samples ᐅ Templatelab

Apology Letter For Being Late In Submission Sample Letter

Free Unpaid Wages Demand Letter Sample Word Pdf Eforms

Sample Tax Notice Response Valid Prettier Models Irs Response Throughout Irs Response Letter Template Letter Templates Lettering Coloring Pages Inspirational

Free Letter Of Intent To Sue With Settlement Demand Sample Word Pdf Eforms

Administrative Assistant Cover Letter Examples Ready Templates